A Glimpse of Potential Investment Returns

As a proactive investor intrigued by the junior exploration landscape, you understand the allure of high rewards but also recognize the significant risks. You've likely experienced the fear and uncertainty of navigating this complex market, perhaps even facing losses that made you question your investment choices.

You may have attempted to go it alone, relying on a clutter of information from investment newsletters or mining industry news articles, or felt overwhelmed by the sheer volume of potential opportunities and how they stack up against one another.

What if there was a more effective way?

MineXWealth (MXW) offers a solution: in part, and central to our mission, is a comprehensive proprietary database built on decades of experience and a deep understanding of the junior exploration lifecycle. This database of companies and projects, available to paid members, provides the analytics and insights needed to make informed investment decisions and unlock the true wealth potential of your investment portfolio.

To illustrate the power of this approach, consider the following three success stories, showcasing how our investment methodology, nicknamed The Distillery, identifies promising juniors and helps investors achieve extraordinary gains.

Success Story #1

NGEX Minerals Ltd | Gain: +1,112% | Copper, Gold, Silver | Hold Period: 2 to 3 Years

In short, NGEX represents two colossal copper-gold deposits in close proximity to one another along the same geologic structural corridor in one of the preeminent copper producing and exploration districts on earth. They sit along the Central Andes, straddling the Chilean and Argentinian border. Both projects are in the neighborhood of several other behemoth deposits.

One is the early-exploration stage Lunahuasi project that is generating monster high-grade and high-volume drill results. NGEX has not produced a maiden resource estimate yet for Lunahuasi, but when they do it will likely be large scale.

The other is the Los Helados project with similar drill results in terms of volume, although lower grade. Los Helados has grown into a frighteningly monstrous copper deposit. The indicated resource so far is 18.4 billion pounds of copper.

A little back of the napkin math, using the current copper price, indicates USD$85 billion+ worth of copper. There is a massive gold and silver component of the deposit as well that would make this a world-class gold and silver mine on its own. The gold and silver are a bonus.

These two deposits are simply enormous. Hence the current relatively large market cap for NGEX of USD$1.38B. Using the Distillery, we identified the company as a strong prospect with good value back in November 2020. Although NGEX stood out in our database, based on the numbers and valuation alone, the truth is we were already familiar with this company because we keep an eye on what key players are doing in the junior mining space.

As a result, NGEX, was on our radar well before the analytics began to flash green. The team at the helm of NGEX have deep roots in the mining business and a stellar track record of creating shareholder value. Keeping tabs on the activity of these folks is every bit as important as crunching the numbers, and can often lead to unearthing promising new projects before the exploration drilling begins in earnest.

Because of their involvement and the low valuation at the time, we got in early. The valuation was so compelling, on an enterprise value per ounce basis, we were comfortable investing 100% of our allocation for this stock all at once. It is wise to break an investment into tranches, but in this case, we went all-in at USD$0.44 per share without a second thought.

Skipping to the end of the story, between July through November 2023, we sold a majority of our holding for USD$4.55 per share, representing a 929% average gain. The best performing trade was at USD$5.36 per share representing a 1,112% gain. We still own a few shares and as of this writing the stock is trading at USD$7.34 per share, representing a 1,568% unrealized gain. We will probably sell and move-on to another current prospect on our radar.

Success Story #2

Luminex Resources Corp | Gain: +3,864% | Gold, Copper, Silver | Hold Period: 5 Years to Present - This is a ‘Special Situation’ and as such does not represent the usual path to success. However, it highlights the extreme gains possible in the gold and copper exploration sector and the opportunities that present themselves periodically to pick-up project exposure for free. Luminex was a spinout from Lumina Gold Corp. in August 2018.

Lumina Gold Corp. itself is another highly prospective junior, currently advancing its world-class Cangrejos gold-copper project in Ecuador. I had previously acquired shares in Lumina while using The Distillery to identify promising juniors.

Lumina decided to spinout all of its other projects into a new publicly-traded company in order to focus solely on Cangrejos. These projects became Luminex, which are very promising on their own merits, especially the Condor gold-copper project, also in Ecuador. As a result, Lumina shareholders received an allotment of shares in the newly formed Luminex to fairly maintain their current shareholder interest in the spinout assets.

Lumina shareholders, who bought their shares to bet on the Cangrejos project, essentially received an interest in the Luminex spinout assets for free! In January 2024, Luminex was acquired by Adventus Mining Corp., yet another solid junior explorer, because its projects in Ecuador complimented the Luminex portfolio. There is a tendency for advancing juniors to coalesce like small oil drops floating on water, connecting into bigger oil drops over time.

Although I received the newly minted Luminex shares for free in 2018, my brokerage account listed their cost basis as USD$0.01, because trying to do math with zeros leads to awkward outcomes. I still own most of my Luminex (now Adventus) shares, although I took some profits off the table to return my initial investment on several explorers, so that I am playing with house money. As of today my remaining shares are trading at USD$0.40!

Success Story #3

Skeena Resources Ltd | Gain: +1,210% | Gold, Silver | Hold Period: 3 to 4 Years - Skeena represents a more straightforward junior investment. Its Eskay Creek project has reached an advanced stage in the exploration lifecycle, as reflected in the company’s $600M market cap. Skeena is advancing its Snip gold project as well and both are past producing mines located in the storied Golden Triangle in British Columbia. Think historic gold rush territory.

The current larger market cap reflects the advanced stage of exploration, the fact that these were past producing mines, and the investor confidence it inspires. The company completed a Definitive Feasibility Study for Eskay Creek in November 2023 and is steadily moving the project towards production.

Using The Distillery, we identified Skeena as a strong prospect with good value back in January 2018. Actually, there is a little more nuance to the story. We were already familiar with the Snip mine because of its connection to a key player that we follow.

In 2017, this person formed Skeena to buy the Snip mine from Barrick Gold, one of the largest global gold producers, which also got our attention. We began to monitor Skeena closely and took note again when they acquired Eskay Creek late that year and began to aggressively drill both projects.

These 2017 developments; the combination of a key player, two high-grade past producing mines, and off the investor radar pricing, along with aggressive drilling, made us buyers.

Using a seasoned trading approach, we dipped our toe in the water at USD$2.57 per share. However, we kept the majority of our powder dry for 12 months. It was still early days, so we could afford to wait. Our patience was rewarded when a far superior entry point presented itself in January 2019, and we acquired a significantly larger tranche at USD$0.92 per share.

In March 2022, we sold a majority of our holding for USD $12.03 per share, representing a 368% gain on our initial smaller tranche and 1,210% on the larger one!

The Ultimate Investment Satisfaction

We are always scanning the horizon for new opportunities like the three success stories presented above, and there are more than a few that are currently on our radar. Returns like these, coupled with investment amounts tailored to your portfolio, and sound trading practices, can have profound wealth effects.

Imagine paying-off debt, accumulating the down payment on a home, financing the start of a new-business, or the satisfaction of watching your portfolio mushroom. We, and others we know of, have experienced the immense satisfaction of achieving these kinds of life goals powered by leveraging the junior exploration lifecycle.

Key Insight: Wealth Generation and The Exploration Lifecycle

It is not overly difficult to comprehend how the lifecycle of a successful junior exploration company can generate considerable wealth for shareholders. From cradle to grave, it is a story of high adventure that starts with improbable success in an often remote wilderness location and ends with its first metal pour leading to commercial production.

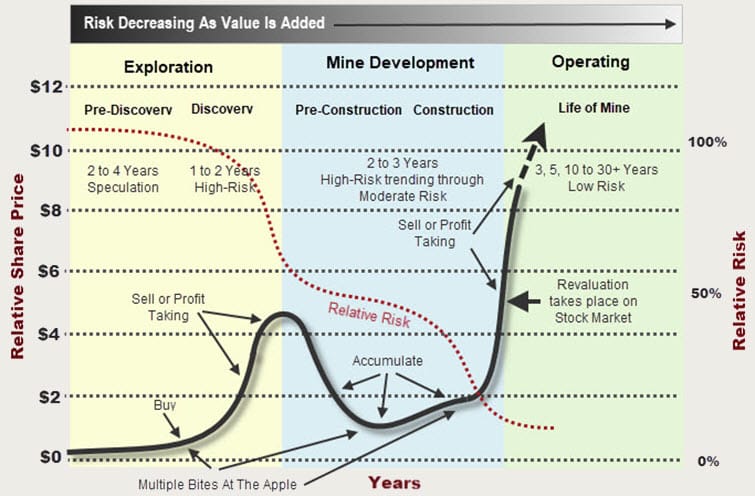

As a project travels from the nearly impossible, to possible, then probable, and ultimately becomes reality, high-risk is steadily transformed into low risk, which creates exponentially explosive shareholder value along the way. This shareholder value is driven by the achievement of well-understood exploration and mine development stages, punctuated by key project milestones, and the press releases that share them to the investment community.

One of the most valuable features of the exploration lifecycle is the predictable rise and fall associated with the oft ignored period before or between key milestones. It is during these lulls in price that we accumulate shares in the most promising juniors. And because this can happen two or three or more times, during the lifecycle, investors typically get two or three bites at the apple. Note that each phase of the lifecycle has a different risk profile, so a portfolio can be built around these various phases.

A Bridge Too Far

Investing in publicly traded junior explorers presents a unique set of challenges. While the potential for extraordinary returns is undeniable, as showcased in the preceding success stories, the path to achieving such gains is often fraught with uncertainty and risk. Navigating this complex landscape requires a deep understanding of the exploration lifecycle, a keen eye for identifying undervalued opportunities, and a steadfast commitment to a disciplined investment approach.

Many investors, captivated by the allure of striking it rich, find themselves overwhelmed by the inherent complexities of this sector. Fear of loss, stemming from the sector's high-risk, high-reward nature, can paralyze even the most seasoned investor. The sheer amount of time required to develop the expertise needed to confidently navigate this challenging investment landscape can seem daunting. And the success stories in this typically ignored and unloved investment niche are relatively few in comparison to the sheer number of publicly-traded juniors in existence. See our article on the nature of this elusive journey.

Yet, for those willing to embrace the challenge and equip themselves with the necessary knowledge and tools, the rewards can be truly transformative.

A Timely Solution

MXW provides investors with the tools, strategies, and guidance needed to confidently and competently invest in the formidable landscape of junior explorers. The company's approach is grounded in decades of experience, a proven track record of identifying successful juniors, and a deep understanding of the nuances that comprise the exploration lifecycle. We help investors overcome the challenges inherent in junior exploration investing and unlock the potential for significant wealth creation.

Bridging the Gap: The Road to Targeting High Probability Success & Generating High Returns

The above success stories demonstrate the extraordinary gains possible in this sector. They highlight the power of leveraging the exploration lifecycle to identify undervalued companies poised for exponential growth. Investors who understand this lifecycle and strategically position themselves can achieve returns ranging from hundreds to thousands of percent.

The benefits of investing in junior explorers extend beyond financial gains. By aligning with a company that possesses extensive experience, a proven methodology, and a deep understanding of the sector, investors can navigate this complex landscape with confidence. MineXWealth empowers investors to transform their dreams into reality, whether it's achieving financial freedom, funding a life-changing goal, or simply building a more robust and profitable portfolio.

We invite you to join us on the wealth creation journey of a lifetime!

“Fortune Favors the Bold”

TESTIMONIALS

“7 FIGURES IN 7 MONTHS”

My first investment to 'test the waters' was a small gold play that made me 105% over a three month period this past summer when the rest of the market was doing nothing.

I bought into another recommendation that has now returned 110% with some boring gold play out of Brazil. I would not be surprised if the only buyers of this company were Frontier subscribers and insiders. Now the investment world is waking up to this interesting discovery.

The third FRR recommendation I bought was a Uranium prospect out of West Africa that is once again up 110%.

Over all my account has grown just over seven figures in seven months.

Please do me a favor and do not tell anyone about their research.

Michael B., Vancouver

“DETAILED DUE DILIGENCE”

So why am I a subscriber to the Frontier Research Report when I could have identified highly profitable stocks on my own?

It takes time to do detailed due diligence. I can check the facts that the newsletter presents as I choose and so far, FRR has an excellent track record.

You know your stuff and one needs a trusted advisor in matters of investing. You came highly recommended. I took my chances, and so far, the results have been impressive.

I am a subscriber for the education you provide and the mental challenge of reading your newsletter and expanding my knowledge of the mining industry.

The returns have been fantastic. Thanks for the service. Keep up the good work.

Regards,

PRS

“PLEASANTLY CONCISE AND DETAIL PACKED”

The Frontier Research Report has more than met its mandate by providing astonishingly quick returns on the investment capital that I have allocated to the natural resources sector.

Among even the best newsletters covering the natural resource sector, few provide the kind of in-depth yet readable coverage found in the pages of the Frontier Research Report.

Each FRR issue is pleasantly concise and detail packed. The newsletter is organized in such a way that allows the investor to make an informed investment decision quickly and with confidence. The investor can then return to the detailed analysis to better understand the company. The newsletter’s geological, geographical, geopolitical and cultural coverage is not only strategically significant but downright enjoyable.

Tyler S., California

Disclaimer:

The investment case studies presented illustrate the potential for gains in the junior resource exploration sector. Past results are not indicative of future outcomes. The information provided is for illustrative purposes only and should not be construed as investment advice. MineXWealth does not assume any responsibility for actions taken based on this information. The case studies presented offer a glimpse into the company's track record and investment methodology. However, this simplified presentation should not be considered a complete representation of the methodology. Detailed insights into the selection criteria and investment approach are accessible to paid members. MineXWealth is not promoting or endorsing the companies mentioned in this case study and has not received any compensation for their inclusion.